I Need To Buy A Car is a thrilling milestone, however the technique can appear daunting if you don’t know where to begin. With so many selections to make and files to organize, the task of purchasing a vehicle feels intimidating.

However, being knowledgeable makes all of the difference. This complete manual will walk you through each step and requirement that will help you understand the whole lot you need to shop for a car inside the U.S. You ask I Need To Buy A Car

Proving Your Income Is Essential for Auto Financing Approval:

One of the most crucial things you need is documentation of your modern day profits, as creditors want assurance you have strong profits to qualify for an automobile mortgage and make bills.

provide at least your remaining 2-4 pay stubs if feasible, highlighting your year to date total income. If just starting a new job, pay stubs may not reflect your full income yet in that case, an official letter from your employer confirming salary, hire date and employment status aids the approval process.

Self-employed individuals can use tax forms like 1099s as income verification. W-2s also work as proof for salaried employees. Bank statements displaying everyday direct deposits are every so often standard in lieu of pay stubs. it’s pleasant to have those files digitally on hand or in print before purchasing and I need to buy a car…

Lenders generally want to see income at least twice the monthly loan payment amount. In case your profits appear low, don’t forget a smaller down fee to decrease payments or observe less costly automobiles. you may also follow with a co-signer who meets profits qualifications to boost approval odds.

Valid Driver’s License Must Match Other ID:

Having a current driving force’s license proves you’re legally allowed to power and is needed to take ownership of any purchased automobile. When presenting your license, make sure:

- Your name and address match other forms of identification you’ll provide

- There are no issues like an expiration date approaching or license restrictions due to past violations

- Your state licensing bureau does not require transferring an out of state license within a certain period of residence

Double check your driving record online if any points or suspensions appear, as that could impact insurance rates or even disqualify you from certain financing programs. Resolving any license issues before starting the car buying process avoids delays.

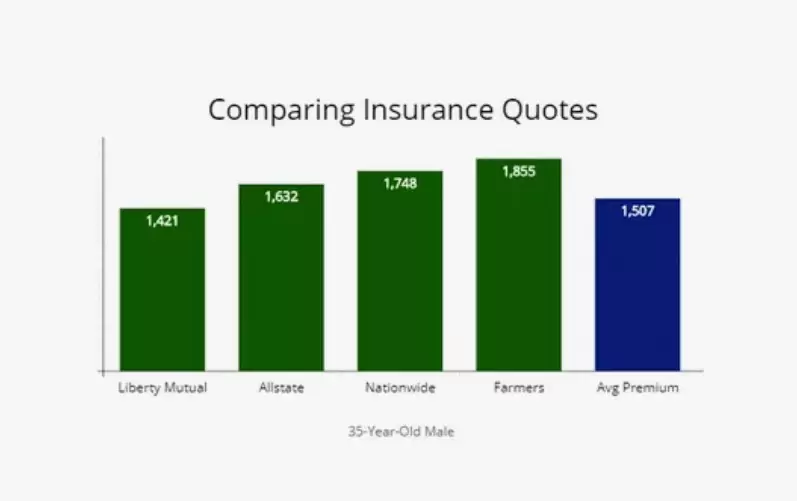

Comparing Auto Insurance Quotes: I Need To Buy A Car

Having proof of insurance in hand is another necessity, as it’s illegal and risky not to insure a vehicle you own. Contact insurers 4-6 weeks prior to shopping for rate quotes based on personal details like your age, location, driving history, intended I Need To Buy A Car and desired coverage levels.

The sample average premiums in Table 1 show ideal rates can vary greatly between regions. When price comparing, take note of deductible amounts too higher deductibles lower premium costs but more out of pocket on claims. Provide your selected agent’s contact info during applications, but I Need To Buy A Car people.

Table 1: Average Annual Car Insurance Premiums by State (Based on Minimum Liability Coverage)

| State | Average Annual Premium |

| New York | $1,663 |

| Michigan | $2,764 |

| Louisiana | $1,420 |

| California | $1,830 |

| Texas | $1,635 |

Verifying Your Home Address for Underwriting

Most lenders want proof of your physical residence for verification in documents dated within 60 days, like utility bills, rental agreements, bank credit card statements, pay stubs or tax forms.

Even with rentals, providing residence information adds reassurance of housing stability versus a transient lifestyle. If documents don’t match your address, including a P.O. Box may suffice as supplemental proof of your mailing location. This lending requirement helps confirm ability to afford long-term payments.

How a Strong Down Payment Strengthens Your Application:

Putting money down, while not always mandatory, displays purchase commitment valuable to financing approval. Aim for 10-20% of the purchase price if budget allows.

Benefits include lower monthly payments through reduced loan principal, less total interest paid, possible avoidance of fees bundled into higher rate programs and greater confidence in you as a borrower by demonstrating “skin in the game.”

Consider setting aside a portion of each paycheck into a separate savings category devoted to your auto fund.

Advantages of Pre-Approval Before Car Shopping

Getting pre-approved for an auto loan lets you shop with estimated financing terms in hand. Your bank or credit union assesses qualifying factors including credit history, income ratios and intended down payment to pre-qualify you ahead of time.

Approval provides estimated interest rates and monthly payment capacity to focus on desired vehicles rather than worry over credit.

Dealership pre approvals also exist for quick “soft” credit checks that avoid hard inquiry dings, but third party lenders often offer better terms. Either way, pre approval delivers conditional financing you can present with bids.

Completing the Loan Application Accurately:

After finding your vehicle, a loan application collects key personal information both digitally and on paper. Provide your legal name, SSN, DOB, residential history, employment details, income sources, bank account references and more.

Review everything carefully before signing to catch any errors, as accuracy expedites the underwriting process and final approval.

Be ready to supply supporting documentation if requested as part of the verification process. Taking time to thoroughly complete the application is worthwhile for prompt results.

Following Through for a Successful Purchase:

With documents and approval in-hand, focus turns to finalizing the deal. Don’t hesitate to negotiate pricing but avoid unrealistic low ball offers that waste everyone’s time.

Consider voluntary product add ones like extended warranties only if providing solid value relative to cost. Read over all agreements closely before signing anything binding.

Trust the preparation process – with organizational skills and financial understanding, there’s no reason the purchase experience can’t be both simple and satisfying. Enjoy the new adventure that awaits behind the wheel of your first vehicle!

FAQ:

Q:What documents do I need to buy a car in California?

A:driver’s license, proof of auto insurance, and financing documents (if applicable).

Q:Can you register a car without a license in CA?

A:Yes. You won’t need a driver’s license to register a vehicle in California.

Q:What do you need to drive a car in CA?

A: Be at least 16 years old.

Q:Can an 18 year old buy a car in Alabama?

A:If the age of majority is 18 in Alabama the answer is yes.

Q:What do you need when buying a car in NJ?

A:your license and proof of residency.

Conclusion:

I need to buy a car is an investment that comes with responsibility and expense. But the rewards of personal transportation independence make it well worthwhile when approached systematically.

I need to buy a car guide has outlined the necessary documents, steps and considerations to give you confidence moving through the buying process.

While it requires patience and preparation, following the process ensures you make an informed decision on a suitable vehicle within your means.

Keeping lines of communication open with your lender throughout establishes you as a reliable customer as well. With diligence, buying a car can prove an exciting new chapter that provides many miles of reliable service.

With over 5 years of dedicated experience in the automotive industry, I am passionate about all things automotive. My journey began with a deep curiosity for automobiles, which led me to delve deeper into their mechanics, technology and trends. My expertise spans various aspects of the automotive world, from the latest electric vehicles to classic car restoration techniques. Through my articles, I aim to share my knowledge and insights, helping readers stay informed and inspired in the fast-paced world of the automobile.